pay indiana state estimated taxes online

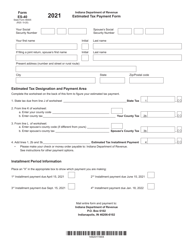

Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable.

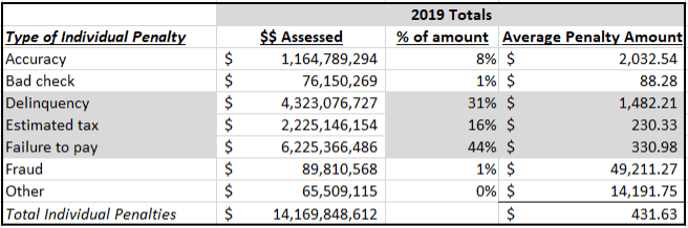

Do S And Don Ts When Requesting Irs Penalty Abatement For Failure To File Or Pay Penalties Jackson Hewitt

Tax identification TID or social security number SSN Credit card information and payment amount.

. TOMORROW NIGHTS JACKPOT ESTIMATED TO BE 12 BILLION. Ad See If You Qualify For IRS Fresh Start Program. INTIME provides access to manage and pay.

Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. Individual Payment Type options include. Free Case Review Begin Online.

Or a lump sum of 432659045IndianaThe lowest state taxes of the Tri-State at 323 Indiana would mean. Online Payment Application Options Make a bill payment. DOR Tax Forms Online access to download and print DOR tax.

Ad pdfFiller allows users to Edit Sign Fill Share all type of documents online. Based On Circumstances You May Already Qualify For Tax Relief. MyTax Illinois If you have an MyTax Illinois account click here and log in.

We last updated the Estimated Tax Payment Voucher in January 2022 so this is the latest version of Form ES. Once logged-in go to the Summary tab and locate the Make a payment hyperlink in the Account panel. Cookies are required to use this site.

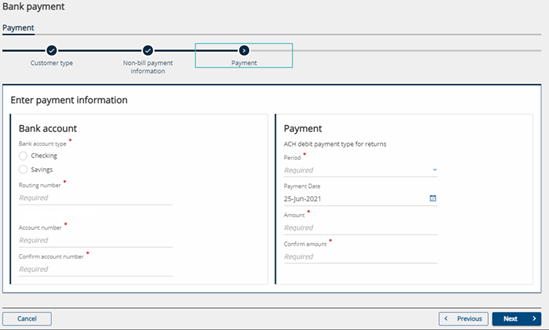

Estimated payments may also be made online through Indianas INTIME website. App Change Ownership More Fillable Forms Register and Subscribe Now. Payment can be made by credit or debit card Discover Visa MasterCard or American Express using the departments Online Services Guest Payment Service directly visiting ACI Payments.

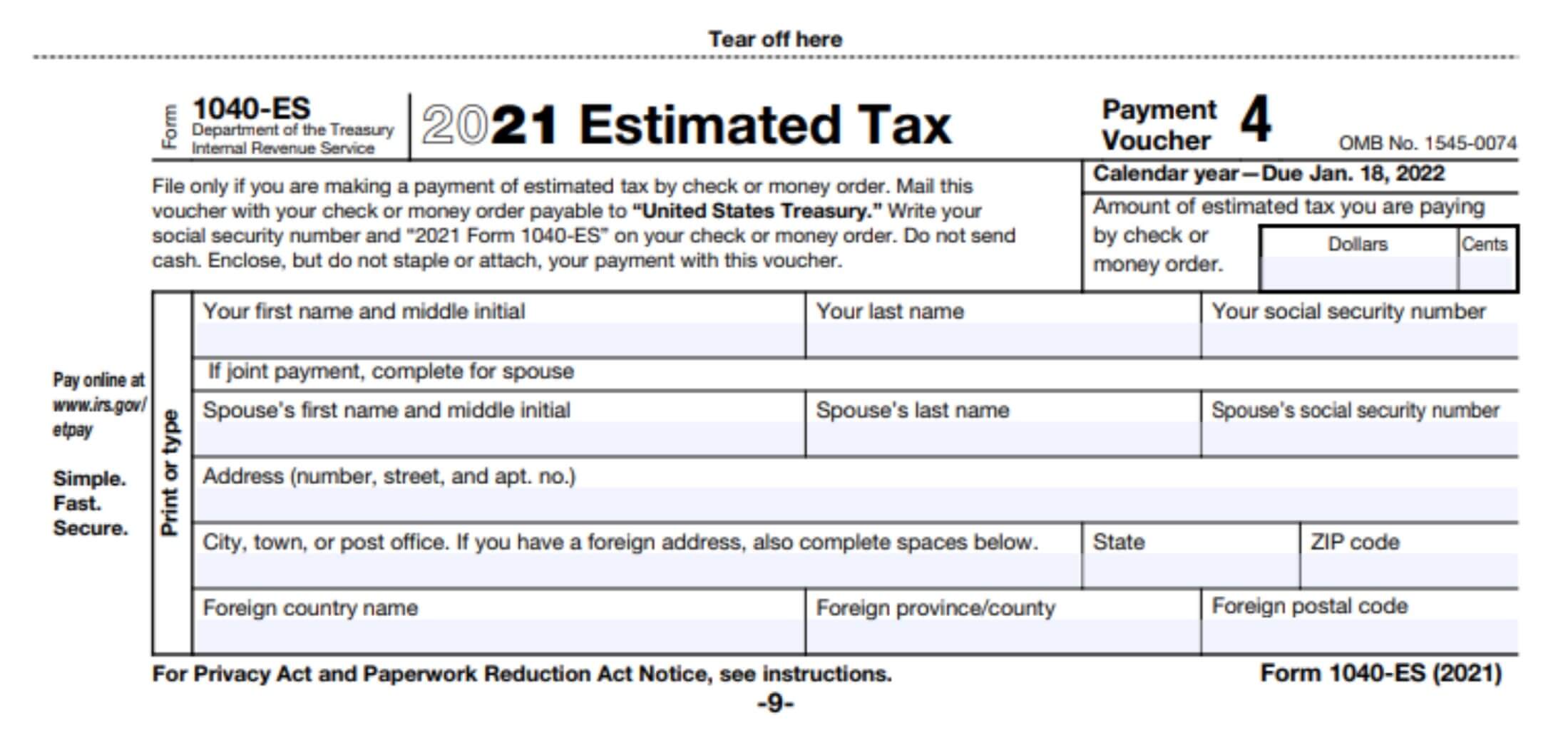

You may send estimated tax payments with Form 1040-ES by mail or you can pay online by phone or from your mobile device using the IRS2Go app. Select the Make a Payment link under the. Use a pre-printed proof of estimated taxes issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated taxes.

Your browser appears to have cookies disabled. Indy Free Tax Prep is a network of Volunteer Income Tax Assistance VITA sites provide through the United Way of Central Indiana that offer free tax preparation to individuals and families with. Personal Income Tax Payment.

If you dont already have a MyTax Illinois account click here. View history of payments filed via this system. Other Online Options Make a personal estimated payment - Form PV.

Check or money order follow the. How To Pay Estimated Taxes. DOR Tax Forms Online.

If paying by electronic check both routing and account numbers are required. Access INTIME at intimedoringov. To make an individual estimated tax payment electronically without logging in to INTIME.

Indianas one-stop resource for registering and managing your business and ensuring it complies with state laws and regulations. Indiana State Tax Information Support How To Pay Your Taxes With A Credit Card In 2022. The Indiana Department of Revenue DOR is in the process of.

The Indiana Taxpayer Information Management Engine known as INTIME is the Indiana Department of Revenues DOR e-services portal. Pay Your Federal Taxes Or State Taxes Due On Efile Com Debit Check State Taxes Pay For Taxes Via Direct Pay Credit Card Or Payment Plan State And Local Sales Tax Rates. Realty Transfer Tax Payment.

How to pay indiana state estimated taxes online Tuesday August 30 2022 Edit.

Quarterly Estimated Tax Payments Who Needs To Pay When And Why

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

How To Pay Estimated Indiana State Taxes

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Guide And Calculator 2022 Indiana Sales Tax Taxjar

As Indiana Considers Second Tax Refund Some Wonder Where S The First Inside Indiana Business

Indiana 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Dor How To Make A Payment For Individual State Taxes

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference

Indiana Paycheck Calculator Smartasset

Indiana Income Tax Calculator Smartasset

Who Should File Irs Form 1040 Es

How To Pay Estimated Indiana State Taxes

Tax Season 2021 Quarterly Taxes Still Due April 15 For Most

Received 1099r With Wrong State Tax Withheld

Dor How To Make A Payment For Individual State Taxes

Form Urt 1 Fillable Current Year Indiana Utility Receipts Tax Return And Schedule Urt 2220